Bitcoin is a unique technology that humanity has never seen before. It enables us to do things like digital fungibility and secure value digitally. Bitcoin is "where money and economics meet code and engineering" for the first time ever. Before talking about Bitcoin, we need to have a clear understanding of what "money" actually is and its origins.

So, let's take a step back before going forward. Following is the table of contents, in case, if you want to jump into the specific topic(s).

Origins of money

Petro-dollar (fiat) as "money"

Why gold failed - its drawbacks as a currency

Bitcoin is a superior store of value

I have broken down the content within each topic into broad subtopics to have a better flow.

Origins of money

It goes back all the way to the 1600s since when coins were minted and used as a medium of exchange in Europe - but, that only takes us back to the coinage era which we know as we spend a dollar or cent in stamped (with the ruler or ex-ruler or founding father of the nation) debased coin having a mixture of silver, brass, and copper. "Money" is something that we perceive to have value within itself to act as a medium of exchange. There are different forms of money or layers if you will. Origins of money can be broadly classified into; coinage and pre-coinage. The latter is where the transaction was even harder because of evaluating the value in itself of commodities, collectibles, precious metals, feathers, shells, teeth, and whatnot.

What is "Money"?

If anywhere or in an interview if anyone asks you "What's the most important innovation that has changed humanity forever?", I would say "money" as the most disruptive innovation we humans as a species innovated that enabled every possible transaction to build the current modern civilization as a whole. It's all delusion and assumption of different people having different needs at different times that can make one thing perceived to be more valuable than the other.

Humans created money way before we innovated writing. In fact, archeological discoveries say the very initial writings have traces of ledger that were penned down by our early people to keep a record of who owed what to whom and to what tribe at what time. Therefore, the very need for writing arose from keeping a record of money in a written form to avoid cheating. The fact that humans had money way WAY before they knew to mint/carve on stones is mind-blowing.

Do animals talk about "Money"?

Animals share a similar intuition of sharing value in return for something. But they have a very distinctive way of interacting and making friends with one tribe and being repulsive with others - that is because of "reciprocal altruism". Monkeys don't know what a dollar is. Have you ever wondered why they snatch one hand with a banana but leave out the other hand that had dollars? They perceive it to be "more valuable" than the dollar and they don't know dollars on the other hand can actually buy them more bananas.

Animals don't know how to value things in order to exchange them for others. Monkeys scratch (groom) each other thinking that they'll get a similar experience from their peer in the near future. That is an exchange of value. But what level of grooming can be as valuable to the one who experienced the grooming in the first place as the other monkey? They all have different levels of satisfaction and valuing them can be immensely hard. There's another caveat for reciprocal altruism where the exchange of value can cease to exist just because the one who had received the service can die or forget and deny that such an event has occurred in the past. This kind of event makes animals choose who they roam with and creates clans within them depending on past events of fraud.

One thing that clearly distinguishes us from other animals is the "wealth transfer" that was made possible due to money. When a monkey (AA) that received grooming dies the next day, then the value exchanged by the other monkey (BB) is simply lost due to the demise. BB cannot claim the grooming from the friends of AA because they don't know whether AA groomed BB in the first place. Even if they do, the other friends can simply deny or offer less satisfying grooming to BB. Not only services or money can be in wealth transfer but can also be status quo and the title. The Industrial Revolution and the end of slavery paved the way for a transfer of wealth in terms of job titles which is a type of invention that was never found in animals.

Pre-coinage and collectibles

The most common form of "money" that humans used in the pre-coinage era was collectibles. Those who live on the seashore think teeth and thick woolen clothing are precious because they are found in the mountains while mountain tribes use seashells as a form of money. People who live in the inland desert perceive water to be more valuable than gold, simply because they are rare. I have attached some pictures of beads, seashells, and other collectibles that were buried deep and found in archeological digs and discovered to be hidden money that went lost due to a civil war that happened between tribes on the above soil.

Detail of interlocking and interchangeable beads necklace from a burial at Sungir, Russia, 28,000 BP.

There's clearly a problem here that not only made the exchange of goods painful but many would have lost their lives just explaining how one collectible can be more valuable than the other when they migrated to different continents. Barter failed to flourish and men went on to find other means to store value and value goods entering the coinage era.

Coinage and precious metals

Precious metals like gold and silver were discovered to be a more common way to store value and exchange them for goods and services because they are stones in rare form and have specific characteristics like gold cannot change form unless it is met with an intense level of heat.

Minting coins in smaller forms was a tedious task. The British pound was called a "pound" because it represented a pound weight worth of a silver coin to be exchanged for services. Since the level of economic activity in the early 17th century was far more advanced, minting coins to the same level of value to make a trade didn't happen because of the labor and time-intensive task of minting and stamping the coin with a ruler's face. To face this issue, the smart insiders in the hierarchy came up with an idea to mint the number "2" on the same pound worth making it capable of buying twice more goods and services out of thin air.

Governments around the world had different payment forms and their own currencies in the form of bronze and silver coins. More importantly Gold.

Gold can be measured as it can be weighed easily and audited individually to verify for counterfeit. However, there was one drawback that hindered gold to be accepted as a wide medium of exchange, especially for international trade because of its portability issues.

Gold failed. Certificates of deposits emerged.

CDs are deposit receipt that enables you to trade the deposit notes as a currency for the exchange of goods and services. If you had 10 pounds of gold, then you can step into a bank, and vault it with them and they guarantee the trader who accepts the receipt can redeem the gold for the value of goods exchanged at any point in time. This system led to the current modern paper money that we call "money".

Petro-dollar (fiat) as "money"

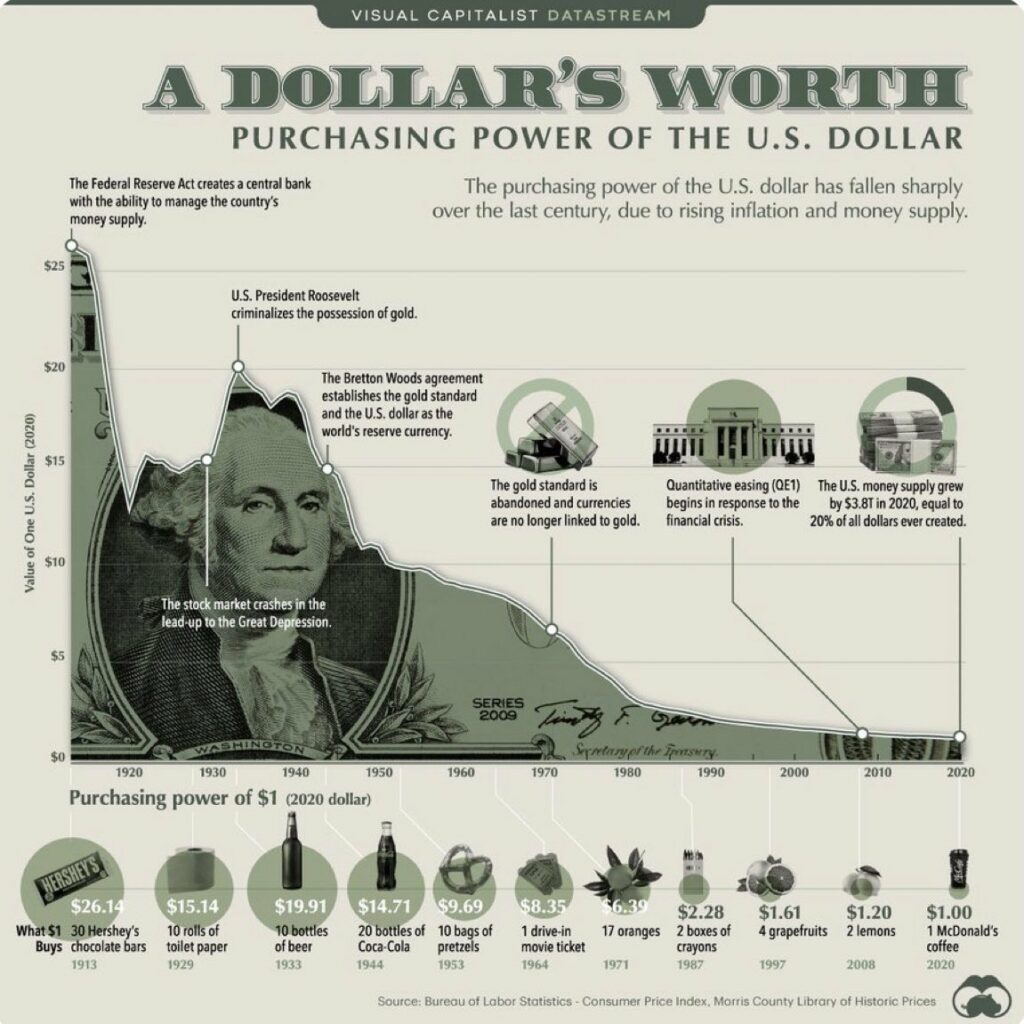

Before 1971, you can redeem your paper money for gold at $35 an ounce at the central bank whenever you needed it. In today's world, we know paper bills as money that says "100" or "1000" printed on a colorful note that denominates the value in it. But, the reality is these numbers are just numbers that never can be redeemed. People keep using the same as they are promised with the signature of the Central Bank Governors of the jurisdiction on the note to pay you some amount in gold in exchange for the paper bills. Guess what? - promises can be broken.

The Bretton Woods and treasury-pegged currencies

After World War II, Governments around the world wanted to have a unified monetary system as trade was happening on a large scale and on an international basis.

The Bretton Woods conference was held in 1944 where 40+ nations came together to accept the US dollar as the supreme currency aka, the mother of currencies. But the thing was one US dollar was tied to gold at $35 per ounce. Thus the establishment of the mother currency and all other currencies will be tied to the dollar. This means the US dollar is equal to an ounce of gold if you have $35. You can exchange it interchangeably. Entering the "gold standard". The US also imposed sanctions on their citizens to hold gold as illegal and warned them that they'd be put behind bars if they held any - this enabled the demand for US dollars within the borders and as a domino effect - to buy things from the US soil, all international trades perceived dollar as the best collateral.

Now, you may ask why was it the US not any other older countries' currency like the British pound. That is because the US had (and still has) more than half of the gold reserves in the world in gold bars after WW2. They supplied arms and ammunition to nations for war and in return gold flowed in tremendously. Making it the strongest in wealth.

So, sounds good right? What happened to the USD?

Decoupling of the gold standard: 1971

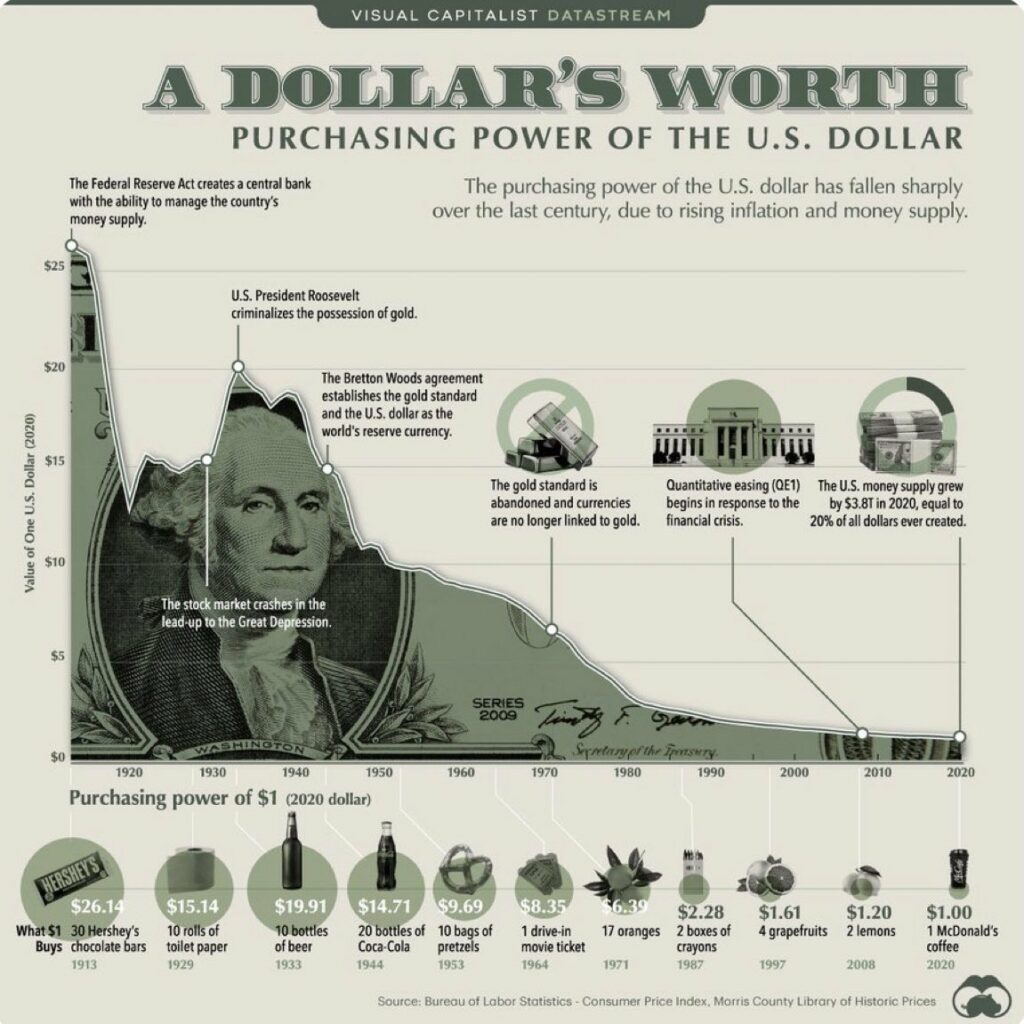

In the year 1971, US President Richard Nixon called for immediate PR and monetary reform and declared that there would be a “temporary” untie between the USD and gold. That is USD will not be interchangeable at $35 for an ounce of gold - now, the gold that backs the USD is no more. Currently, USD has no intrinsic value behind it, and the Government has started to print money how much ever it want without caring about inflation while manipulating the value of gold.

Today an ounce of gold is around $1,700. 40 years back you can buy an ounce of gold for $35 and now you can’t. This is called the devaluation of a currency - or about 4700%+ of inflation.

Any paper bill, be it a dollar or pound you can tear or burn and you can create another one. There’s no intrinsic value behind it.

Somewhere around the 1970s, the US proposed various acts strengthening its diplomatic ties with oil-rich countries. Today, if you are a sovereign country that wants to import energy, which is oil, your own currency won't buy, you need to have dollars. The American army is camped all over the Gulf countries and other OPEC countries saying they want to protect their citizens, love them more, and whatnot. But, at the core, they are actually protecting the oil that is getting pumped out and watching out for enemies who try to devour the petrodollar standard. Not to mention, Russia (an oil-rich country) has been a long-term enemy of the US in the past because of oil wars and the Russian government doesn't want to use the dollars to price their homeland resources.

The petro-dollar era and the banks are dying...

If you are an investor or closely follow business economics, you should have come across the name of a 98-year-old legend Charlie Munger - who is a close acquaintance of Warren Buffet saying that the dollar and central bank currencies do not have a strong history. Just like how other forms of money failed to withstand, fiat currencies are going to zero in the next 100 years. Attached is the video of his comment -

The banks will be dead unless they adopt this revolution. Why would anyone trust the banks anymore if people are exposed to what they are doing? The fractional reserve system that is still unknown to 90% of the population is worrisome. All the savings people have deposited in the banks are not theirs anymore.

Not to mention, the recent Canadian Govt law on freezing the bank accounts, and investment accounts of the Canadians who supported the truckers for raising their voice against vaccine mandates - just to express their opinion in a free world. It wasn't China or Korea where strict rules exist, this coming from a western country that is highly civilized sent a shock throughout the internet. The hard-earned money of people becoming inaccessible to them for any essentials is terrifying. People are now waking up realizing the banks do not care about the customers but the higher officials above their heads and their bottom line. All these actions are making individuals find an alternative that is a self-custody, more secure, and extremely private payment system that no entity can take down or freeze.

When people find that can hold and manage their own wallet with a private key, and send funds over anywhere anytime without the need for a third party, then the game is changed forever.

"Children of our future will be their own banker; an international banker with a Bitcoin wallet and they wouldn't know what a dollar is or "3-to-5 business days" mean nor have a bank account."

Andreas Antonopoulos

British-Greek Bitcoin advocate, tech entrepreneur, and author

The general public is losing interest and they don't feel safe anymore using traditional bank accounts. Even smart money has allocated Bitcoin in their portfolio. Here's Bill Miller, a legendary fund manager who beat the market consecutively for 15 years through to 2005 talking about his 50% net worth bet on Bitcoin.

Why gold failed - its drawback as a currency

It has better history but not portability for 7 billion people today. Gold has some industrial use cases like embedding on silicon chips and wiring makes it top of the commodity list as we learned how the shortage of semiconductors and its raw materials can skyrocket the prices of the underlying during the COVID-19 pandemic.

Mining and minting the coins in smaller forms and keeping them circulating in an era where everything is digital and facilitates international payments seems outdated. As technology scales, it makes human lives feather-light. A token that is natively digital, purely peer-to-peer, moving at the speed of light, and has the characteristics of gold - the limited availability, divisibility, and linear cost of mining - is literally magical and revolutionary technology. Enter Bitcoin.

What is Bitcoin? - a superior store of value

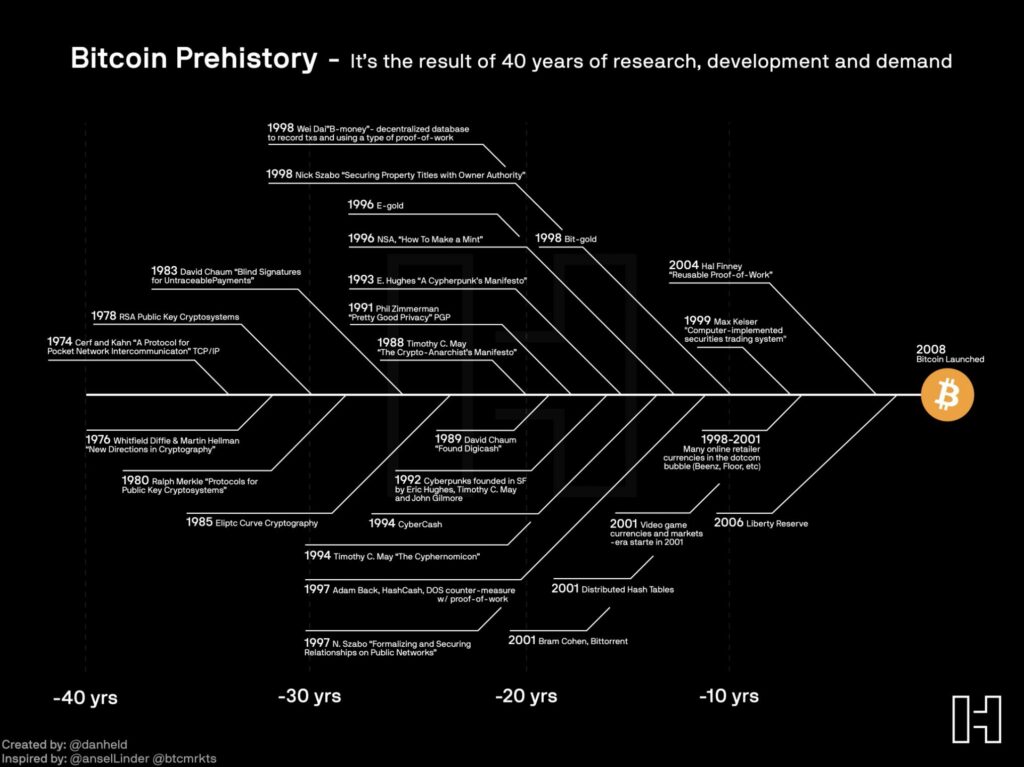

Bitcoin is a natively digital currency developed by an individual or any group of individuals using the pseudonym Satoshi Nakamoto. Bitcoin white paper was put out in 2008 and was launched on Jan 3rd, 2009.

It came right after the 2008 financial crisis when big banks were creating nuance and causing a housing market crash that made many in the US insolvent. What’s more frustrating is the banks were bailed out by the government - where the general public has entrusted the authority to punish individuals/entities involved in such frauds.

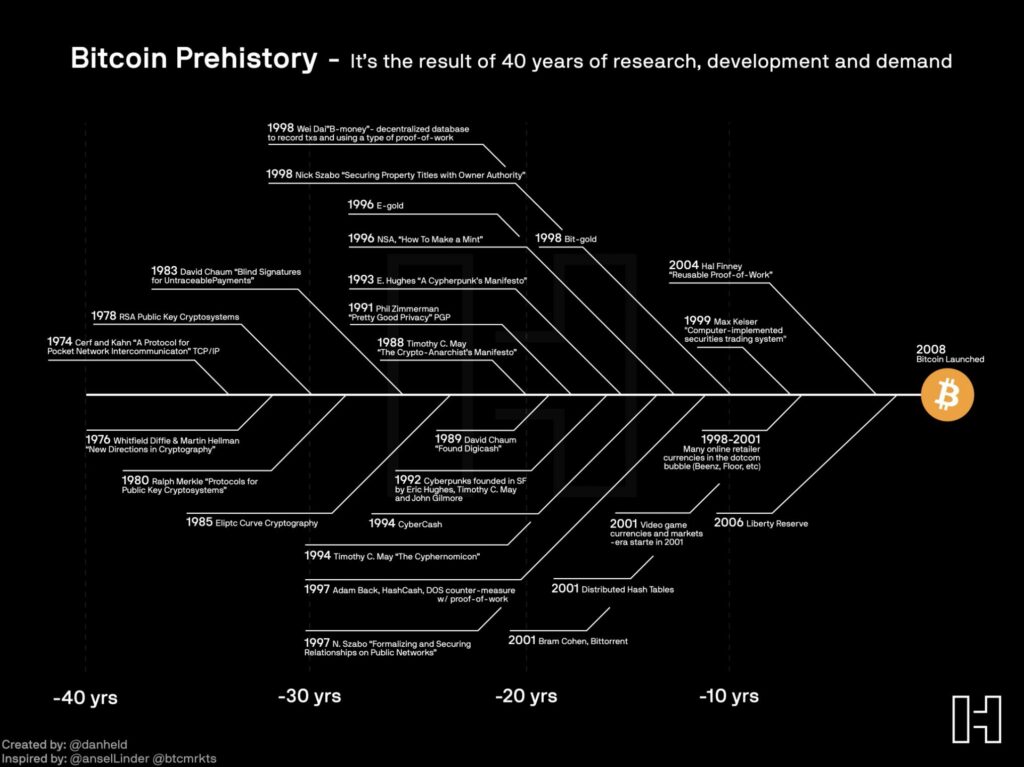

Bitcoin didn't pop out of the blue. There were well-known cryptographers working on technologies underpinning Bitcoin back in the '80s and '90s. Satoshi made it possible by taking each of the innovations as one cohort. Even a non-techie economist Milton Friedman had predicted such technology is inevitable in the years on the internet coming ahead -

Bitcoin solves our current monetary problem. It has a fixed supply of 21 million coins and can be sent to anyone anywhere in the world at the speed of light.

Every single Bitcoin (1.00000000) is divisible into 8 smaller denominations called “sats” or “satoshis”. That is 1 Bitcoin is = 100,000,000 satoshis.

Since it is divisible to fractions, portable at the speed of light, and most importantly scarce in nature - fixed at 21 million Bitcoins, many believe it to be an asset and has the potential to dethrone Gold as the supreme commodity.

As Micheal Saylor, a whale HODLer of Bitcoin says -

Link

When everything is digital, the same information can be duplicated with a click of a button. Let's say you have an image of your pet and want to share it with your friend, you can choose to send that over iMessage or WhatsApp, and boom - now, you and your friend both will have the same image and no one knows which was the original one. Now, that is completely fine if you are exchanging information, but to exchange value there has to be someone (a trusted entity or revolutionary trustless technology running on pure mathematics) overlooking the tokens spent are not spent again to buy commodities - the so-called "double-spend" problem. Here's Adam Back, a cypherpunk specializing in cryptography talking on the following podcast diving deep into the hashing and double-spending problem that Bitcoin solves - the internet was missing(before Bitcoin) to transmit value across the globe.

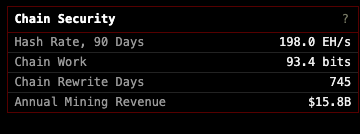

Bitcoin's security

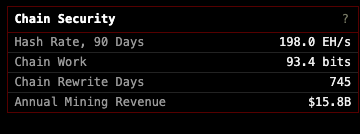

Okay, now you may ask about how secure is Bitcoin and what ensures that your money is safe as it is based on the internet and any hacker can tamper with it.

That’s a good question.

A hacker can tamper with a database by cracking the code and gaining access to the information on the server. That is, a hack can happen when he knows where the particular server is and ways to manipulate/inject/break encryption and/or make believe the server that he is an insider of the company.

Bitcoin is not a server-based software but a software protocol running in consensus with other peers running the same software and building a blockchain (more precisely known as time-chain) where each new child block is connected to its previous parent block, thus making it a long chain of transactions. This blockchain system makes it harder to crack because a hacker should not only hack the current block but also all the previous blocks. It is literally impossible to hack a blockchain. At the current hash difficulty, if you have a super-computer, it'll take about 745 days to "rewrite the chain" or to create a parallel longest chain for a hacker to take control over. But, every 10 minutes a new block is mined - so, the hacker has to start from the beginning to rewrite the chain. Bitcoin is one hell of a tamper-proof invention.

Quantum Computing and Bitcoin

The Bitcoin protocol is encrypted with the SHA-256 algorithm which is the most secure algorithm in tech to date. No technology on the planet today has broken SHA-256. However, as the famous Moore's law goes - every technology will double its performance and significance with an even lower cost than what is today as time progresses. Currently, quantum computing is not a threat to the blockchain, at least not to Bitcoin as the network is hashed at an astonishing rate by the miners. The computers we use - at the backend, it's all binaries, i.e., 1's and 0's. In a given loop of a program, if the output is said to be true, then it returns 1, otherwise as 0. However, quantum computing can spit out results that are both 1's and 0's at the very same time. It breaks the laws of physics and goes deep into stuff that is more minute than the tiniest atoms - commonly known as quantum physics.

In simple terms, if we compare a real-life event that is plausible but at the same time after a threshold, it seems impossible and possible at the same time. Let's take a car that is moving at 200 km/h. You can tell there's a car moving, but at a very high speed that you can barely see who was driving it.

If you increase the speed a little more than 500 km/h, you'll only be able to tell if something went passed you but wouldn't know what it was. If the car moves at 1000 km/h - it is impossible to see the car and one could argue the car was never there - but in reality, the car was there. This is what quantum computing is about - for a given output the answer can be both true and false.

However, there is some limitation in the laws of physics that makes it impossible for the car to travel at Mach 1 or at the speed of light - simply because the car would lift itself off the ground and take off in the air. The same applies to current innovation in quantum computing - after a certain threshold, the super-computers that interpret what a quantum computer is doing are not able to figure out what's happening inside the quantum computer.

We still have a long way to go for quantum computing to flourish and to be able to crack SHA-256 encryption. Breaking SHA-256 will not only be a threat to Bitcoin and blockchain technologies but to the internet as a whole. All the credit card details that you used to purchase online where it said "256-bit secured", our personal information in the Govt. database, and the ultra-secret military innovation in the US Pentagon computers will be vulnerable.

I highly recommend following

Quantum topics in Bitcoin Optech where the types of threats Bitcoin faces like Quantum Computers are predicted to be able to generate signatures corresponding to Bitcoin public keys without knowledge of the original private key (owner), allowing someone possessing a fast QC to spend UTXOs belonging to other people and a lot of other topics are actively discussed by Bitcoin devs and proposals to keep the network Quantum-proof.

Here's Andrew Fursman co-founder and CEO of 1QBit - a Quantum research organization based in Canada explaining about current complexities of quantum computing and what it means for Bitcoin.

Plastic money

Today, there are billions of people around the globe and there are tens of thousands of merchants who partner with POS providers to facilitate plastic money - Visa and Mastercard. The customer who makes the payment doesn't know how the transaction takes place in the backend. But the merchant who takes the credit card has to pay obscene fees of 2% to 4% for every card they swipe. For the big retail giants like Walmart or Amazon - it's peanuts. But thinking the small to medium-scale business owners who run their shops on a mere margin of profit have to pay a share to the Visa or Mastercard network. Why?

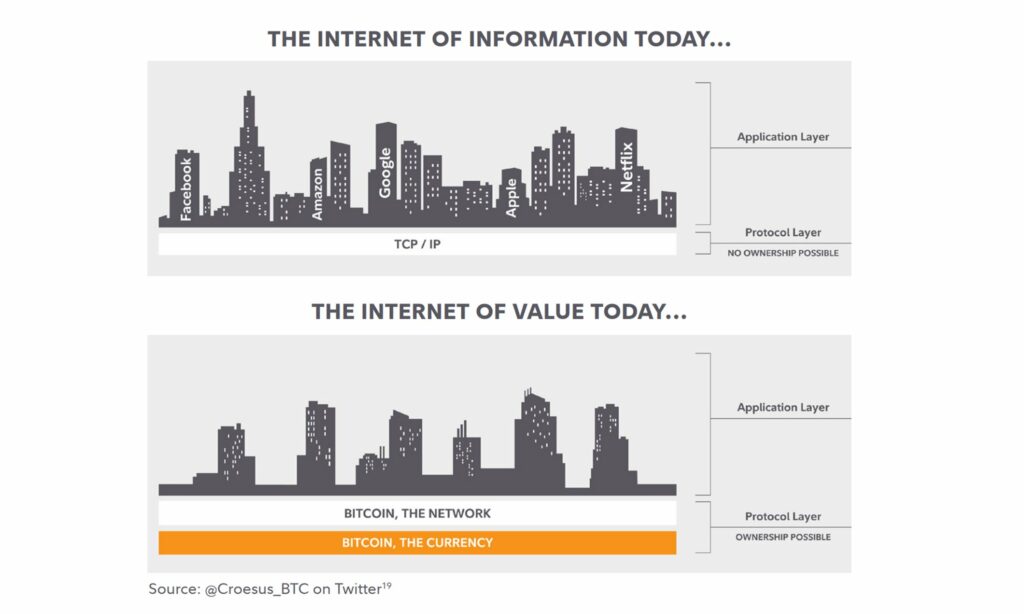

Bitcoin's layer 2 lightning network can bring freedom to merchants who need to accept cross-border payments by transacting the most scarce digital asset at the speed of light with little cost. That's a game-changer.

The long-term view for Bitcoin

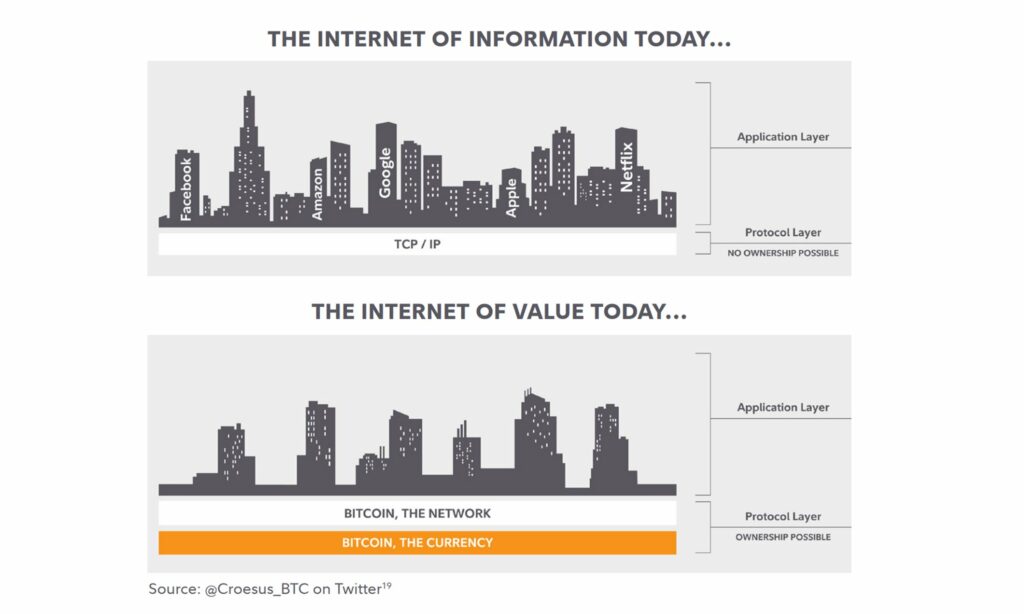

Thinking long-term about these two assets - five years from now, one thing is certain - Bitcoin will become the global reserve currency, and Ethereum will be running a Google-like search engine and privacy-focused social media platforms (more on this later). Let me walk you through my perspective of Bitcoin first.

We need to be brief on what money is first. Let's go back 5000 years, when they are only two countries (let's name them Gigi) far from one another and used to trade now and then. The barter system was the primary mode of transaction, that is the demand for one product in one country should meet the supply of the other. There was so much friction that Gigi started to look at things that they think it has some value - pebbles, shells, and rocks. The only problem with the new currency is how to value it. They wouldn't know how much rocks should be accepted to exchange for cattle or any other good. There would have been some serious commotion on this that we can't even think how pain in the ass it would have been if we were born back then.

Now, let's bring in a third country (Bella) that has found gold and has been using gold for some time, and when Bella reaches Gigi, they come to know they are using worthless pieces of rocks that are found abundant and starts to teach them why Gold is superior due to its natural properties. But, what do you think? Will Gigi sit down and listen and accept a piece of rock that weighs the same except the color is just yellow? Gigi would mock them and ask them to leave the borders without turning back thinking they are lunatics using yellowish rocks.

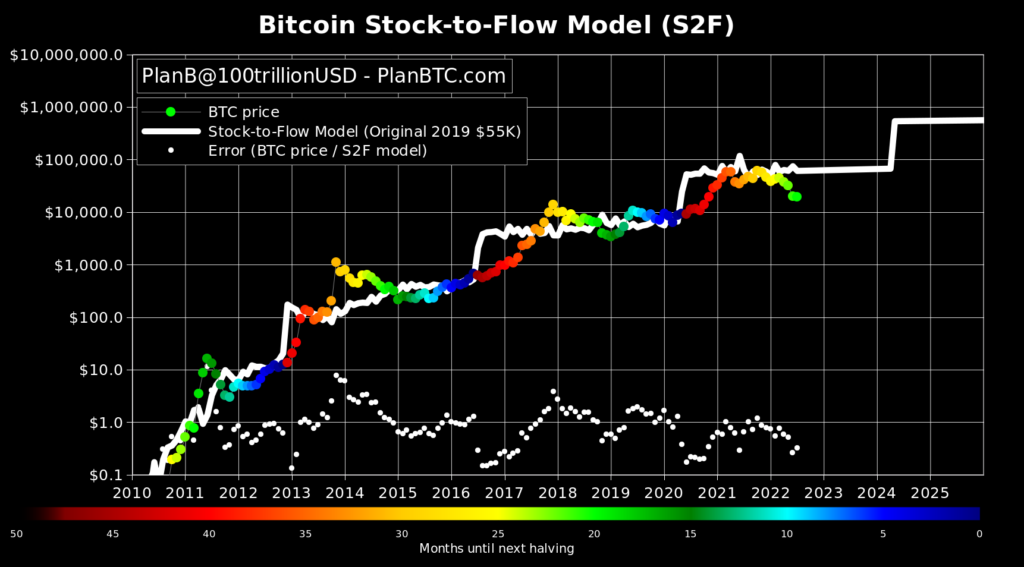

Guess what, with today's tech we know Gold is a true store of value. Look how things have come a long way and now we are able to measure Gold according to the stock-to-flow model. It wasn't easy, our forefathers would have gone through this pain, especially those who lived in the price discovery phase.

That is what exactly is happening for Bitcoin right now. We are still in the price discovery phase of Bitcoin. What is laughable is we are trying to measure something that is literally magic with something that is worthless (dollars). Soon the dollar will cease to exist as citizens will lose trust in their Govts. and central banks as inflation is ravaging the savings of the people. Not only Bitcoin, any new stuff that a person or a group or person presents as a superior way to store or exchange value, will be highly criticized.

One of the fathers of marginalist economics, William Stanley Jevons,

explained that:

"Historically speaking… gold seems to have served, firstly, as a commodity valuable for ornamental purposes; secondly, as stored wealth; thirdly, as a medium of exchange; and, lastly, as a measure of value."

William Stanley Jevons

English economist and logician

Regulators are tuning in recently and countries like Ukraine and El Salvador are already holding Bitcoin in their treasuries. There are just small nations without much capital. When the big ones, sovereign wealth funds, and corporations accept them as legal tender, Bitcoin will moon in terms of dollars.

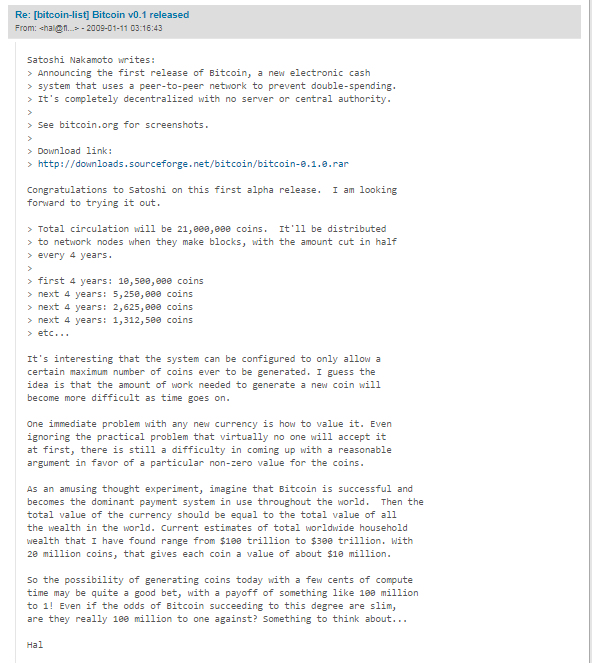

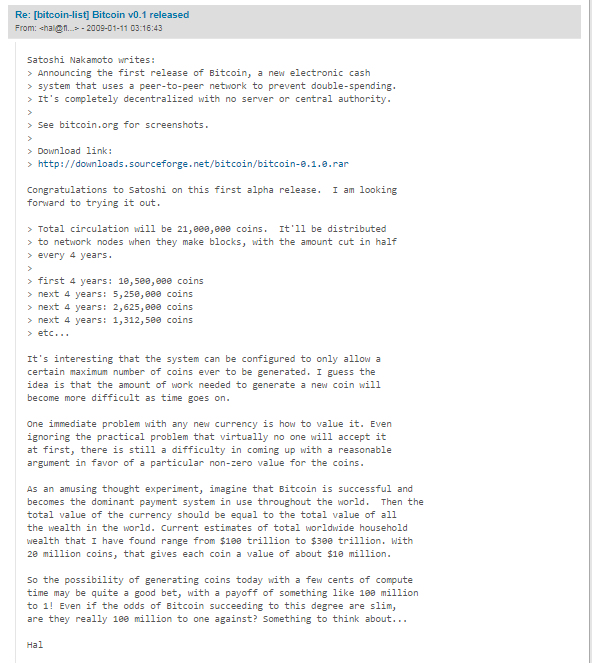

I would like to shed some light on something. Hal Finney is the first person to receive the first Bitcoin transaction of 50 BTC from Satoshi while mining the genesis block. Hal is one of the great cryptographers, he worked closely w/ Satoshi and is still being praised by engineers. Hal made the following statement in the early stages of Bitcoin, like in 2009 -

Here's a more clear version of the last 3 important paras -

He's predicting, that if Bitcoin goes mainstream, it will eat all of the wealth - at the time of his writing ~ $100 Trillion, but with today's inflation, the global assets would easily be worth ~ $500 Trillion. That would give each coin worth about $50 million.

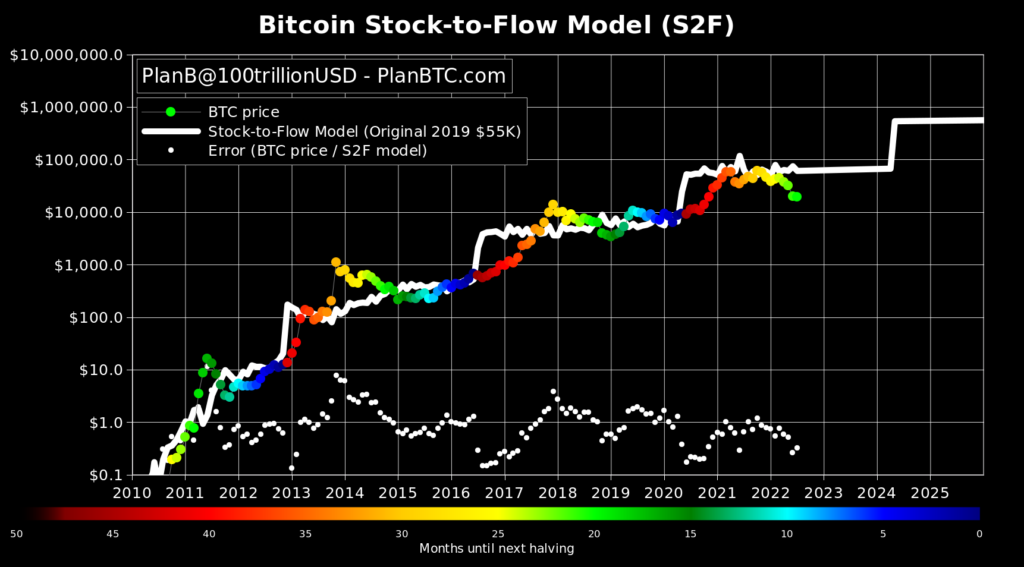

Well, that number seems completely off, but here's a stock-to-flow model by

Plan B, a familiar Bitcoin technical analyst on Twitter -

The trend of monthly close (colored lines) has been moving as the forecasted line in white, where the scarcity of the asset increases every four years that is when halving occurs. The number is climbing towards $10 million by 2025 and I feel the price would be even higher.

Sooner or later fiat will be abandoned and people who own one full Bitcoin will be one of the 21 million millionaires on the planet - The Wealthiest. Everything will be denominated in sats.

We live in fortunate times.

How can you fit all of the wealth in 21 million coins? Yes, that is a great question. But, a single Bitcoin is cumulative of 100,000,000 smaller denominations called "sats". Today, the world economy, and resources, are worth about $100 trillion. I.e, if Bitcoin is denominated in sats -

I. 1 Bitcoin = 100,000,000 or 100 million sats

II. 21,000,000 Bitcoin = 2,100,000,000,000,000 or 2.1 quadrillion sats

In a nutshell, a $100 trillion economy can fit in Bitcoin and still have 10x (free space) of wealth to be created when Bitcoin is denominated in sats.

What is Ethereum and can it compete with the OG Bitcoin?

On the other hand, Vitalik and others are grinding to make things scalable by creating a decentralized web to abolish the monopoly of the big tech companies. Since Ethereum offers smart contracts that enable some economic automation and scalability, despite the indefinite supply, some investors are more bullish on Ethereum than Bitcoin.

NFTs offer a way to censor your identity on social media platforms. For example, you can buy a CryptoPunk or BoredApe or mint one to tailor your taste and use them on your social media profiles and not expose your real face. With deep fakes and AI, it is really scary to upload profile pics or photos online that get stripped away in milliseconds and sold. When most people start to use NFTs as their identification on social media platforms, it creates a digital world where nobody will get to know who we actually are but will be benefited from our information. A privacy win-win for both parties.

Not to mention, they also serve as artwork that cannot be stolen (technically), unless transferred and recorded on the blockchain.

If you couple privacy with blockchain, it gives a whole orgasm. Sometimes, have you ever thought when viewing a profile on LinkedIn that he/she mentioned alumni of Harvard or Stanford but after you hire them and come to know they were not even 'elite' enough to come close to Tier 2 colleges?

This is a common issue that is being unsolved for years in the internet age. Verification of identity is crucial today. Blockchain-backed level 2 projects like Ethereum and Cardano are trying to fix this issue. When a person is born, the time he/she is born, location, and identity is put on the blockchain and when they enroll in a school, it gets timestamped and recorded on the blockchain of that person. Essentially keeping a real verifiable record of things that happened in life. Cool, right?

Similarly, think of real estate. Taking every piece of land on earth and its ownership onto the blockchain. Any transfer of property and the price will get recorded on-chain. When there is a calamity in your living place and if you lose the physical registered documents of your properties, you can still prove that you own a piece of land by pulling the data from the blockchain.

Talking monetary, I don't know what will be the price of one ETH after five years, but definitely higher than what it is today. Since there was a recent forking that allowed the Ethereum network to burn some part of gas fees making Ethereum technically more scarce as more and more people transact ETH.

Thus, both have tremendous use cases in their own ways. Bitcoin is a monetary network (kind of digital gold) - not fast but acts as a store of value. Ethereum is digital oil that has real-world use cases in cyberspace.